Aidu Wind Farm Finalises Capital Raising for EUR 150 million Investment Grade Dark Green Bond on Frankfurt Stock Exchange

- Financing the final phase of 100MW onshore wind farm in Estonia, Europe

- Investment Grade, Dark Green, SFDR article 9 classification

- Estonia’s highest rated international bond, first ever international green bond

Tallinn, Estonia – July XX, 2022

Aidu Wind Farm (“Aidu”) is finalising capital raising for a EUR 150 million investment grade green bond to finance the final phase of a 100MW wind farm, led Eleon AS, an Estonia-based renewables technology innovation group.

Key Facts about the Bond

Rating: BBB+

SFDR: Article 9

Second Party Opinion: Dark Green

Issue Size: EUR 150 Million

Duration: 12 Years

Yield: 5% + Capital Repayment

ISIN: GB00BPW5RV72

Listing: Frankfurt Stock Exchange

Senior Secured: Yes

The bond has been issued by Sustainable Capital PLC, a green bond issuance platform recognised on the Nasdaq Sustainability-Bond Network, and structured by U.K. based Bedford Row Capital PLC, a global non-bank structuring specialist. The wind farm is in its final phase of development including grid connectivity with groundworks and infrastructure already completed. The project also benefits from a fixed price EPC Contract (Engineering, Procurement, Construction Costs) and is fully permitted. Aidu has received a BBB+ investment grade rating (Stable) from credit rating agency EuroRatingTM based on the high DSCR (average of 2.46) and the security of the PPAs, which are made up of a fixed-rate Estonian government (AA- stable outlook) subsidy at €53.7/MWh as well as the Nordpool market price (June average price 178 MWh).

The green bond has also received a ‘Dark Green’ Second Party Opinion and SFDR ‘Article 9’ classification by CICERO based on the Environmental Impact Assessments (EIA) undertaken the biodiversity and local impacts being considered. As Aidu is being built on land previously degraded by shale oil mining activities, the local community has reacted positively to the new, greener activity. This makes Aidu the highest rated international bond coming out of Estonia and the first international green bond from Estonia.

Andreas Sõnajalg, CEO of Eleon AS, said: “To meet the IEA’s net zero by 2050 targets, wind power must increase 11-fold between now and 2050. Aidu is a huge step in that direction – upon completion Aidu will become the largest onshore wind farm in the Baltics and a key contributor of renewable energy to Europe’s leading energy market, Nordpool.”

Dr Scott Levy, CEO of Bedford Row Capital, commented: “With the E.U wanting to reduce foreign gas imports by 2/3 this year and gain independence from them entirely by 2027, Aidu’s clean energy is key to Europe’s long-term energy freedom from both fossil fuels and foreign imports.”

Notes to Editors

This announcement does not constitute, and may not be used in connection with, an offer or solicitation in any place where offers or solicitations are not permitted by law. An offer or solicitation will be made only through an investment memorandum and other related documents with respect to a particular investment opportunity, and will be subject to the terms and conditions contained in such documents.

For more information, please contact:

rhea@bedfordrowcapital.com

About Eleon AS

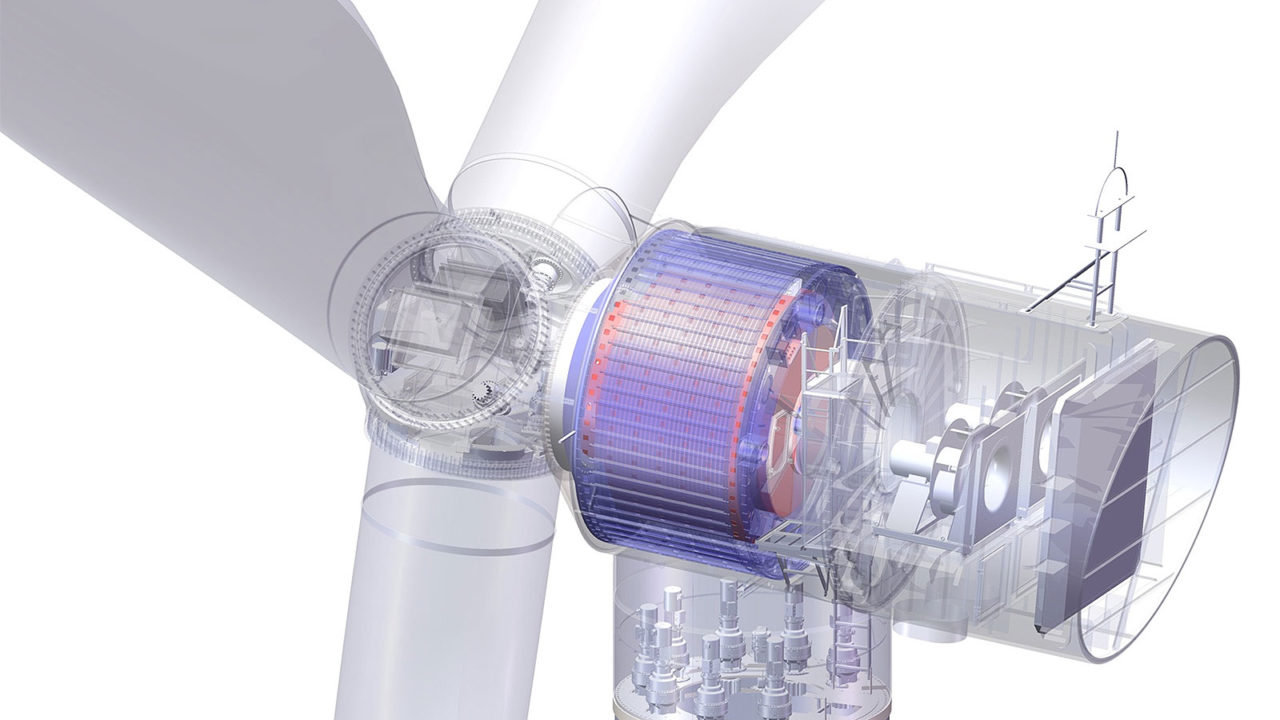

Eleon AS (“Eleon”) is an Estonian-based energy company established in 2007 focusing on renewable energy, mostly from wind farms, as well as the manufacturing of wind turbines. The company has three wind farms in operation, totalling 14 MW, and four under development, including one offshore, totalling approximately 1,500 MW. Proceeds under the framework will exclusively finance the development, construction, and operation of Aidu wind farm located in North-East Estonia. This project will comprise 28 turbines of 3.4 MW each and will have a production total capacity of 100 MW. All the wind turbines will be manufactured by Eleon.

About the Issuer

Sustainable Capital PLC is a UK-based green bond issuance platform (recognised on the Nasdaq Sustainability-Bond Network) which offers a flexible, quick to market solution for green and sustainable businesses. Sustainable Capital PLC is a cost-efficient solution for high impact projects which comply with international green bond standards.

For more information, please contact:

info@sustainablecapitalplc.com

About Bedford Row Capital

Bedford Row Capital (“BRC”) is an award-winning provider of global structured securities solutions which includes the issuance of investment-grade bonds, green bonds, senior secured conventional debt, short-dated notes, delta-one trackers and Shariah compliant certificates. The use of standard settlement infrastructure, combined with Bedford Row’s proprietary information systems, offers an innovative level of transparency and security for both issuers and investors. In a fast-growing market, Bedford Row is ranked inside the top 100 originators globally and one of the leading non-banks in the market.

For more information, please contact:

info@bedfordrowcapital.com